Usury is a term that is now near-universally misunderstood, perhaps by design, because usury is a very popular practice, and many important people benefit from it. The most common definition you will see for it is “charging excessive interest,” probably from American legal issues and legislation that don’t deal with usury at all.

Usury’s actual definition is “charging interest on a mutuum loan.” The word usury comes from charging interest on the use of money rather than the use of an asset.

Mutuum is not a very common word. A “mutuum” means a loan of fungible things to be replaced by the same kind of things. Wheat for wheat, water for water, money for money. For example, if John loans Paul ten dollars so he can buy dinner, that is a mutuum loan because Paul expects to get ten dollars back later—not the same ten dollars, but a different equally valuable ten dollars (hence fungible, or interchangeable). It’s a different but fungible quantity because the money is consumed by its use (important detail as we shall see). Charging interest on the loan is usury; for example, if John demanded eleven dollars as repayment instead of ten.

This is different from something like a home loan because the mutuum is attached to a person, not an asset. That’s very important.

Why usury is a sin and why it was forbidden for most of the Middle Ages requires stepping outside of the modern mindset and thinking about economics and contracts in a more classical and medieval way.

The modern way loans are explained goes something like this (I’ve heard similar explanations from several economists):

John deserves interest on the money he lends to Paul since John is forgoing the use of his money, which he would prefer to spend today, until tomorrow.

This makes the loan seem licit as well as fair since both parties are agreeing and both parties are getting something out of the agreement. This is a modern assessment based on the liberal idea of consent equalling morality. However, it misses what money and its “use” are, the root of “usury.” Whether the interest is usury or not depends on what Paul is spending the loan on.

To go back to a home loan, a borrower, Paul, gets money from a lender, John, to buy a home. Paul gets to enjoy the home, paying back Paul a little at a time, and John gets a return on his investment, a bonus for not using his money on himself, or so it goes.

In reality, Paul and John have entered into an ownership contract together. John buys the house, and Paul buys it from John for a specified amount over time, at the conclusion of which John’s stake in the house ends. The interest is for Paul’s use of the house (which John owns but is not using). What happens if Paul fails to make his payments? John can take possession of the house and use it or dispose of it (sell it) and is therefore made whole. Meanwhile, John paid when he could for the use of the house.

A loan attached to an object protects the borrower and the lender from unforeseen future circumstances. If the contract fails, both parties walk away without anything lost between them.

A mutuum is very different from this arrangement. To go back to the dinner example, what if Paul cannot pay John back? He can’t vomit up his dinner and give it to John to make his lender whole, nor would John want that. Paul is at the mercy of John since he must give John money and cannot give him what he used the money on, and his debt only increases as long as he is unable to pay.

Here is where the ethics of usury come in. If the loan is attached to a person, then the lender, like owning a portion of a house, car, or business, owns a portion of the person. In essence, the usury loan is John enslaving (at least in part) Paul. This goes further, however.

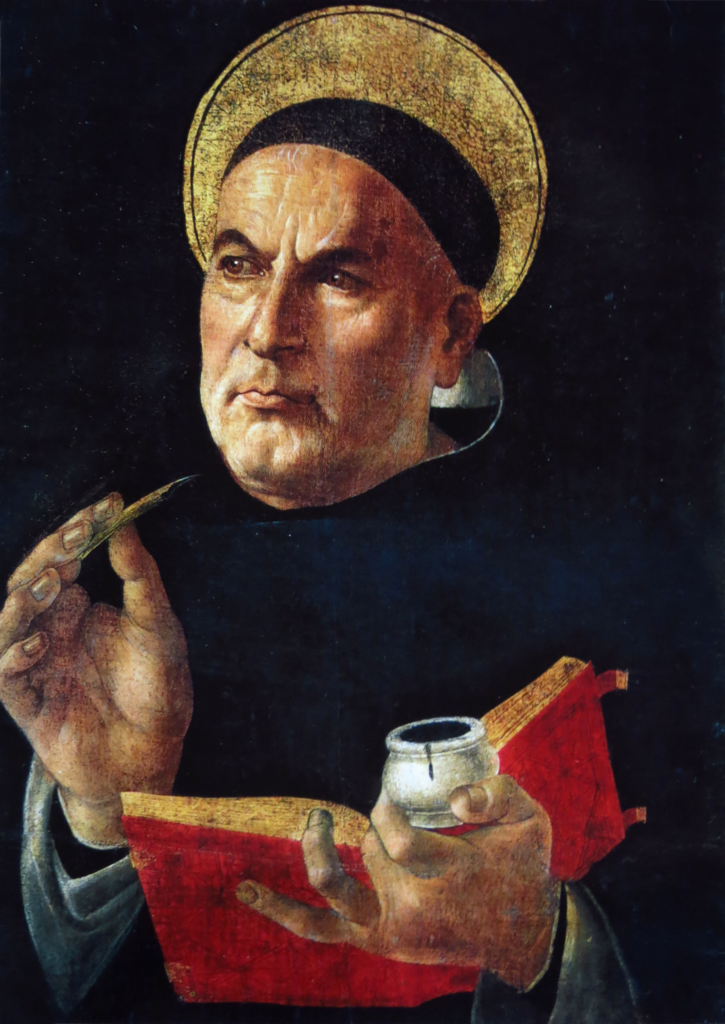

St. Thomas Aquinas says that taking usury for money lent is unjust in itself because it is selling something that does not exist because money cannot be sold separately from its use; it is consumed by use and cannot be held and used independently. Aquinas compares this to wine. When you give somebody wine to drink, you necessarily transfer ownership of the wine since it is consumed when drunk. You can’t continue to own it once it has been swallowed. Charging to own the wine and drink the wine separately would be selling a thing that does not exist; money, similarly, cannot be sold as a use separate from itself. Houses, by contrast, are things that can be used and owned separately, so loans attached to houses aren’t usury.[1] The interest is charged for the use of the house, while the principal payment is the means by which the borrower gains full ownership of the house.

Furthermore, money is a unit of measure; charging interest for money (and its use), in effect, introduces two different units of measure. The usurer has charged more for a thing than its actual stated measure, which means the interest is a kind of theft. So, John charging interest for Paul to buy a meal is stealing from Paul by charging him more than the stated value of the food for its use. It’s a scam. He’s charging Paul for a thing that doesn’t exist separately from the food itself – its use. Hence, we get the difference between usury and a loan. A loan is attached to a thing.

Regarding more direct ideas of sin in the Christian tradition (again addressed by Aquinas), the Jews were forbidden from engaging in usury with one another (their neighbors). Since Christians are to love their neighbors, that also means not engaging in usury.

However, you can make a mutuum loan out of charity—not demanding interest. John can lend Paul money so he can buy a meal, and Paul can pay John back when he is able. If he is never able, John is at a loss, but the loan was made in charity, without a firm expectation of profit, because John saw that Paul was hungry. In effect, he gave Paul the money with the expectation that John would return the favor at some unspecified time in the future. Paul could give John back extra, in which case, the extra is a kind of gratuity—a charitable thank-you for spotting him the money. But like a tip, this is voluntary.

It would be the same if John had tended Paul’s fields when Paul was ill. If Paul did not (or could not) tend John’s fields another day, John could not then demand that Paul work as his slave for more and more time the more he put it off. If John lent Paul a bicycle, he could, of course, expect to get the bicycle back when he wants it since a bicycle is not consumed with its use.

But what of the morality of borrowing under usury? Is it wrong to take a mutuum loan with interest? Aquinas also covers this possibility as well. In brief, it is lawful to take usury loans but not to give them, so long as the person taking the loan is not inducing the lender to engage in usury. The sin is on the usurer, not the borrower, and one may make use of usury to an intended good end so long as the usurer is engaging in the sin by his own profession; that is, it is a sin he already committed and continues to commit, or a sin he would continue to commit if the borrower did not take the loan.

You can see under these definitions our modern world is filled with and perhaps sustained by, usury. It’s deeply ingrained into our economy and the general understanding of debt. Courses and books detailing how to “get out of debt” are almost always directed toward the crippling effects of usury because the easiest forms of debt to acquire are, in fact, usury.

Credit cards are usury because the loan is attached to the person, not to specific objects a person buys with the credit card, and may also use a credit card to buy services that cannot be repossessed. While it is not immoral to use a credit card, since they are issued by professional usurers by definition, it is immoral to be the lender (usurer). A borrower is not morally at fault if he cannot repay, and the loan can be discharged through bankruptcy—the debtor does not go to prison.

Student loans are usury because they are money used on a consumption product, education, not an asset. Education is an experience. The student cannot relinquish his memories to the U.S. government when he no longer can service his student loan debt, nor can he surrender his degree. A degree is a thing that does not exist ontologically; it is a certification of an experience. You can burn your creative writing diploma, but you’ll always have your Bachelor of Arts degree. Student loans are special here in the U.S. because they, unlike credit card debt, can never be disposed of through bankruptcy, only through full payment or death. It ought to be no surprise that the ballooning of higher educational costs began in the early 2000s, around the time the usury of student loans no longer became dischargeable through bankruptcy. Like credit cards, it is not immoral to use student loans since the financial institutions that issue or proctor them are usurers by profession. The debtor is not, however, morally required (he may be legally required) to fulfill the terms of the loan since the loan is unjust in itself.

Home loans are not usury for the reasons described above. Car loans aren’t either, since a car and its use can be separated. Business loans, likewise, are not usury since a business institution is a thing with value itself, it can be transferred in whole or part to other owners, and creditors have claims on the capital goods a business buys with a loan if it ends up bankrupt. Interest is for the use of capital goods, not money, presumably. Bonds are not usury since the bond is attached to an object—municipal bonds for things like schools or business bonds for things like a capital investment.

Usury also reverses the normal operation of service when it comes to banking, especially when it comes to state-enforced usury like in the U.S. Officially, a depositor earns interest on his money by allowing the bank to make use of it. They lend the deposited money out for things like home and business loans and pay the depositor a portion of the interest the bank earns. This is called fractional reserve banking since the bank only keeps a fraction of the deposit in reserve and loans out the rest. However, usury charges interest in reverse since the usurer is entitled to everything he gave the lender plus interest. Since the loan is tied to a person, not an object for use, it is exactly equivalent to a deposit made under full reserve rules, where the bank keeps all money in reserve. Under full reserve, the depositor pays the bank to keep his money safe. Because of the full guarantee, the credit card company ought to be paying the debtor interest. Again, this is not obvious because of how we are trained to think of debt. The big distinction is whether the money being lent is attached to an object that can be used separately from its ownership and is, therefore, a loan, and whether the money is being lent for personal consumption, in which case it is usury. The purpose of this essay is to define what usury is and why it is immoral under classical ethical considerations, not to define what is to be done about usury, usurers, or systems which create by their nature large amounts of unjust usury, such as universities. Indeed, it is hard to even conceive of what our world would look like without (at least state-enforced) usury, but I think it is worth a thought.

[1] https://www.newadvent.org/summa/3078.htm

Under normal circumstances, I’m an author of fiction, but you can check out my creativity manual below.